Running a trucking business in 2025 means juggling countless expenses while waiting 30-90 days for payment. That's where truck factoring companies come in - they're the financial lifeline that keeps your wheels turning and your business thriving. I've spent years in this industry, and I know firsthand how crucial cash flow is to keeping trucks on the road.

Choosing the right factoring company is one of the most critical decisions a trucking company owner can make. Given the industry's reputation for difficult contract cancellations, it's essential to make the right choice from the beginning. We analyzed the most searched factoring companies online to identify the best one for maintaining your company's cash flow.

To keep this content free for you, our reader, we partnered with the best factoring company. The commission we receive from them supports our research and the information we provide. Unlike many review sites, we prioritize maximum transparency. Click here to learn about our compensation structure and our partnership. Click here to see our ranking criteria.

While we've conducted thorough research to make these recommendations, please note that our review does not guarantee service quality. Always conduct your own due diligence before making a decision. Here are our findings.

-

30 lenders researched

-

5 cateogires scored

-

20 data points evaluated

BEST OVERALL FACTORING COMPANY

TAFS

-

Greatest amount of cost-reducing client benefits

-

Quickest funding available, 365 days a year

-

Extensive industry knowledge and experience

-

Mobile App Can be Better

5 Best Trucking Factoring Companies In 2025

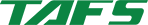

1. TAFS

- Rates: As low as As low as 2.49% for a single truck company

- Funding Timeline: Multiple options including 1-hour advances

- Banking Affiliation: isn’t owned by a bank

TAFS is more than just a factoring company; it's a dedicated partner for trucking businesses seeking growth and success. With a commitment to delivering exceptional client experiences, TAFS offers a wide range of services, including 1-hour advances, ProDispatch freight sourcing, a comprehensive maintenance program, and even trailer leasing through REPOWER. TAFS's unique focus on building strong relationships and providing a true consultant approach sets it apart from the competition, making it a top contender for the best factoring company.

We're placing TAFS at the top of our list of the best factoring companies because of its commitment to customer service, its dedication to innovation, and its comprehensive suite of benefits designed to help trucking businesses thrive. From the speed of its advances to its cutting-edge mobile app and client portal, TAFS consistently delivers solutions that streamline operations, maximize profits, and empower entrepreneurs in the trucking industry.

TAFS Features

| Feature | Description |

|---|---|

| 1-Hour Advance Option | Get paid fast with 1-hour advances, even on nights, weekends, and holidays. |

| ProDispatch | Access specialized freight dispatch services for various trailer types, including Dry Van, Reefer, Power Only, Hotshot, and Flat Beds. |

| TAFS Mobile App and Client Portal | Streamline operations with automated invoice generation, paperless management, and 24/7 account access. |

| Premier Customer Service | Receive dedicated support and expert guidance from TAFS's consultant-focused team. |

| Full Advance Program | Customize your factoring experience with flexible advance programs to fit your business needs. |

| Truck Maintenance & Repair Program | Save significantly on maintenance costs with discounts at TA, Petro Stopping Centers, TA Express, MHC, and Goodyear locations. |

| 24/7 Online Account Access & Free Credit Checks | Monitor your account and make informed business decisions with free credit checks. |

| Collections Support | Let TAFS's Collections Team handle customer payments, allowing you to focus on running your business. |

| Trailer Leasing | Conveniently access a wide range of trailers through REPOWR, minimizing empty mileage and maximizing earnings. |

| Business Loans | Access additional financial resources through TAFS's business loan offerings. |

| Website | https://www.tafs.com/ |

| Phone Number | (913) 393-6110 |

2. Triumph Business Capital

-

Rates: As low as 0.50%

- Funding Timeline: May take a couple of days

- Banking Affiliation: Triumph Bancorp

Triumph Business Capital, now operating under the name Triumph, stands out as a leading provider of freight factoring solutions. They offer a comprehensive suite of services, including same-day funding, fuel discounts, and insurance options, catering to owner-operators, fleet owners, and freight brokers. Their commitment to personalized service and dedication to maximizing cash flow for their clients has earned them a strong reputation in the industry.

We've placed Triumph at number two on our list of best factoring companies due to their exceptional customer service, flexible payment options, and wide range of services tailored to meet the unique needs of trucking businesses. Their focus on building strong relationships with their clients and their commitment to helping them succeed makes Triumph a valuable partner for anyone looking to streamline their finances and grow their business.

Triumph Business Capital: Key Features

| Feature | Description |

|---|---|

| Services | Freight Factoring, Truck Insurance, Fuel Cards & Discounts, Equipment Finance, Asset-Based Lending |

| Target Audience | Owner-Operators, Fleet Owners, Freight Brokers |

| Key Benefits | Same-day funding, fuel discounts, flexible payment options, comprehensive insurance solutions |

| Customer Service | Highly rated for its responsiveness and personalized approach |

| Reputation | Strong reputation in the industry for its reliability and commitment to customer satisfaction |

| Website | https://www.triumph.com/ |

| Phone Number | (866) 356-0888 |

3. OTR Solutions

-

Rates: As low as 0.50%

- Funding Timeline: May take a couple of days

- Banking Affiliation: An independent factoring company

OTR Solutions is a leading factoring and back-office provider dedicated to supporting the success of small and mid-sized trucking businesses. They go beyond traditional factoring by offering a comprehensive suite of services, including transportation factoring, brokerage factoring, and fuel card programs, all designed to streamline operations and maximize profitability for carriers. While they consistently rank among the best factoring companies, we place them at number three due to their focus on innovation and their commitment to personalized customer service, making them an excellent choice for carriers seeking a trusted partner to navigate the complexities of the transportation industry.

OTR Solutions stands out for its unique approach to customer care, offering dedicated account managers, responsive communication, and a commitment to finding solutions that work for each individual carrier. Their transparent pricing, flexible factoring options, and user-friendly technology platform further solidify their position as a top choice for trucking businesses seeking to optimize their cash flow and manage their operations efficiently.

OTR Solutions Features

| Feature | Description |

|---|---|

| Services Offered | Transportation factoring, brokerage factoring, OTR Fuel Card, ELEVATE (branded website and email platform) |

| Target Audience | Small and mid-sized trucking businesses, owner-operators, and freight brokers |

| Key Differentiators | Dedicated account managers, personalized service, transparent pricing, innovative technology, commitment to customer success |

| Strengths | Strong customer relationships, reliable cash flow, user-friendly platform, comprehensive support, industry-leading fuel card program |

| Weaknesses | Limited marketing presence, may not be as well-known as some larger factoring companies |

| Overall | A solid choice for carriers seeking a reliable, customer-focused factoring partner with a range of innovative solutions. |

| Website | https://www.otrsolutions.com/ |

| Phone Number | (770) 882-0124 |

4. RTS Financial

-

Rates: As low as 0.50%

- Funding Timeline: within 24 hours

- Banking Affiliation: Shamrock Trading Corporation

RTS Financial is a leading provider of factoring services for trucking companies, offering same-day funding and competitive advance rates. They differentiate themselves through their simple, transparent pricing with no hidden fees, fast and responsive customer service, and a commitment to integrity. We are placing RTS Financial at number 4 on our list of best-factoring companies due to their comprehensive suite of services, including a fuel card program with substantial savings, and their innovative RTS Pro app, which streamlines business operations and provides valuable tools for truckers.

RTS Financial excels in providing a seamless and efficient experience for their clients. Their focus on technology is evident through their RTS Pro app, which offers features like online invoice uploading, load board integration, and credit checks on brokers and shippers. This combination of robust services, competitive rates, and a user-friendly platform makes RTS Financial a strong contender in the factoring industry.

RTS Financial Features

| Feature | Description |

|---|---|

| Factoring Services | Same-day funding, competitive advance rates, transparent pricing, no hidden fees |

| Fuel Card Program | Substantial savings at over 3,000 locations, credit lines up to $3,200 per truck per week |

| RTS Pro App | Online invoice uploading, load board integration, credit checks on brokers and shippers, fuel savings search and booking |

| Customer Service | Fast and responsive, dedicated to client satisfaction |

| Industry Focus | Dedicated to serving trucking companies |

| Additional Benefits | Discounts for U.S. veterans, bundle options combining fuel and factoring |

| Website | https://www.rtsinc.com/ |

5. TBS

-

Rates: As low as 0.50%

- Funding Timeline: provide same-day funding for invoices

- Banking Affiliation: company operates independently

TBS Factoring Service, a company with over 50 years of experience, is a trusted name in the trucking industry, providing reliable cash flow solutions, insurance assistance, account service, compliance and permitting support, and free authority processing. While TBS offers a comprehensive suite of services and boasts a strong reputation, it sits at number 5 in our list of "best factoring companies" due to its limited geographic reach. While serving a large customer base, their service area is restricted to specific regions, which may not be ideal for truckers operating nationwide.

TBS stands out with its commitment to fast and easy service, offering same-day payments for delivered loads and a quick, free set-up process. They also prioritize customer satisfaction, evident in their dedication to providing personalized support and resources.

TBS Factoring Features

| Feature | Description |

|---|---|

| Service | Freight Factoring |

| Payment Speed | Same-day payments |

| Set-Up | Free and can be done in 24 hours |

| Credit Checks | Free, unlimited, and top-quality credit checks |

| Customer Service | High priority on customer satisfaction |

| Advance Program | Up to 50% advance on factored loads |

| Fuel Discount Cards | Up to 90¢ a gallon discount on fuel |

| App | TBS: Get Paid® App for managing finances |

| Geographic Reach | Primarily serves specific regions, not nationwide |

| Years of Experience | Over 50 years |

| Phone Number | (866) 899-7080 |

| Website | https://tbsfactoring.com/ |

What Is Truck Factoring? Understanding the Definition

Truck factoring definition: It's a financial service where trucking companies sell their outstanding invoices to a truck factoring company for immediate cash instead of waiting 30-90 days for payment. This truck factoring service has become essential for owner-operators and fleet owners who need consistent cash flow.

Truck factoring (also called freight factoring or trucking factoring) works like this:

- You deliver a load and get a signed bill of lading

- You submit the invoice to your factoring company

- The factor advances you 85-95% of the invoice value (usually within 24 hours)

- The truck factoring company collects from your customer

- You receive any remaining balance minus the factoring fee

Why Truck Factoring Services Matter in 2026

The trucking industry operates on thin margins, and waiting 45+ days for payment can kill your business. Truck factoring services solve this by providing immediate working capital. Instead of turning down loads because you can't afford fuel, you can keep your trucks moving and your business growing.

Current Truck Factoring Rates in 2026 - What You'll Actually Pay

Understanding truck factoring rates is crucial for your bottom line. Based on my extensive research of truck factoring companies in 2026, here's what you can expect:

Truck Factoring Rates Breakdown:

- Recourse factoring rates: 1.5% - 3.5% per invoice

- Non-recourse factoring rates: 2.5% - 4.5% per invoice

- Variable rates: Start at 2% for first 30 days, then 0.5% additional per month

- Flat rates: One percentage regardless of payment timing

What Affects Your Truck Factoring Rates?

When comparing truck factoring services, these factors determine your rates:

- Invoice volume: Higher volume = lower truck factoring rates

- Customer creditworthiness: Better customers = better rates from your truck factoring company

- Contract terms: Longer commitments may get discounts

- Industry experience: Established trucking companies often get better rates

- Average invoice size: Larger invoices may qualify for lower percentages

How to Choose the Right Truck Factoring Company

Selecting the best truck factoring company for your trucking business requires careful evaluation. Here's what to consider when comparing truck factoring services:

Essential Questions to Ask Truck Factoring Companies

- What's included in your truck factoring rates?

- Watch for hidden fees that some truck factoring companies charge: setup, ACH transfer, monthly minimums, termination fees

- How fast will your truck factoring service pay me?

- Look for same-day or 24-hour funding from truck factoring companies

- Ask about weekend/holiday availability for truck factoring

- What are your truck factoring contract terms?

- Avoid truck factoring companies with long-term contracts if you're just starting

- Understand termination requirements for the truck factoring service

- Do you offer true non-recourse truck factoring?

- Get specifics on what situations the truck factoring company covers

- Many truck factoring services only cover bankruptcy, not general non-payment

- Which brokers/shippers does your truck factoring company work with?

- Ensure the truck factoring service will factor your regular customers

- Ask about the approval process for new brokers

Red Flags When Choosing Truck Factoring Companies

- Long-term contracts (more than 1 year) with high termination fees

- Vague truck factoring rates - if the truck factoring company won't give clear rates, walk away

- Poor customer service during sales process from the truck factoring service

- No online portal or mobile app for truck factoring in 2026

- Truck factoring companies requiring all invoices to be factored regardless of customer

Benefits of Truck Factoring Services

Working with a reputable truck factoring company provides numerous advantages for your trucking business:

Immediate Cash Flow from Truck Factoring

The primary benefit of truck factoring services - get paid in 24 hours instead of 30-90 days. This means:

- Never miss payroll when using a truck factoring company

- Keep fuel tanks full with help from truck factoring

- Handle emergency repairs through truck factoring services

- Take advantage of new opportunities with consistent cash from truck factoring

Back-Office Support from Truck Factoring Companies

Quality truck factoring companies handle:

- Invoice processing and billing through their truck factoring service

- Collections calls and follow-ups as part of truck factoring

- Credit checks on brokers/shippers included with truck factoring services

- Dispute resolution handled by your truck factoring company

Business Growth Through Truck Factoring

With steady cash flow from truck factoring, you can:

- Add trucks to your fleet using truck factoring services

- Hire quality drivers with consistent pay from truck factoring

- Accept more loads knowing your truck factoring company has your back

- Expand into new lanes with support from truck factoring

Risk Mitigation with Truck Factoring Companies

Professional truck factoring services often provide:

- Broker/shipper credit checks before you haul

- Fraud prevention tools from experienced truck factoring companies

- Payment guarantee through non-recourse truck factoring

- Industry insights and warnings from your truck factoring service

Common Truck Factoring Mistakes to Avoid

When working with truck factoring companies, avoid these costly errors:

1. Not Reading the Truck Factoring Contract

I can't stress this enough - READ EVERY WORD from your truck factoring company. Look for:

- Minimum volume requirements in the truck factoring service agreement

- Hidden fees buried in legal language by truck factoring companies

- Termination penalties and notice requirements for ending truck factoring

- What's actually covered in "non-recourse" truck factoring services

2. Choosing a Truck Factoring Company Based on Rate Alone

The lowest truck factoring rates aren't always the best deal. A 1.5% rate from a truck factoring company with $50 ACH fees, monthly minimums, and poor service costs more than 2.5% with no fees and great support.

3. Ignoring Customer Service Quality at Truck Factoring Companies

When you need funding fast or have an issue with truck factoring, customer service matters. Test the truck factoring service's responsiveness before signing.

4. Not Shopping Around for Truck Factoring Services

Get quotes from at least 3-5 truck factoring companies. Truck factoring rates and terms vary significantly between providers.

5. Using Truck Factoring Without Need

If you have strong cash reserves and all customers pay within 30 days, truck factoring services might not make sense. Calculate if truck factoring improves your bottom line first.

Getting Started with Truck Factoring Services

Ready to partner with a truck factoring company? Here's your step-by-step guide:

Step 1: Assess Your Truck Factoring Needs

- Calculate your average monthly expenses to determine truck factoring requirements

- Review your customer payment history before choosing truck factoring services

- Determine if you need recourse or non-recourse truck factoring

Step 2: Research Truck Factoring Companies

- Use this guide to compare best truck factoring companies

- Read actual user reviews of truck factoring services

- Check BBB ratings for truck factoring companies

Step 3: Get Multiple Quotes from Truck Factoring Companies

- Provide the same information to each truck factoring company

- Compare total costs of truck factoring services, not just rates

- Ask about all fees upfront from truck factoring companies

Step 4: Review Truck Factoring Contracts Carefully

- Have a lawyer review the truck factoring agreement if possible

- Understand termination procedures for the truck factoring service

- Clarify any confusing terms with the truck factoring company

Step 5: Start Small with Truck Factoring

- Consider spot truck factoring first

- Test the truck factoring company's service

- Gradually increase volume with your chosen truck factoring service

Frequently Asked Questions About Truck Factoring

What is truck factoring?

Truck factoring is a financial service where truck factoring companies purchase your unpaid invoices for immediate cash. Instead of waiting 30-90 days for payment, truck factoring services advance you 85-95% of the invoice value within 24 hours.

How much do truck factoring services cost?

Truck factoring rates typically range from 1.5% to 4.5% of the invoice value. A $2,000 invoice at 2.5% costs $50 to factor. Your specific truck factoring rates depend on volume, customer creditworthiness, and whether you choose recourse or non-recourse truck factoring.

Can new trucking companies use truck factoring services?

Yes! Truck factoring companies approve based on your customers' credit, not yours. This makes truck factoring perfect for new trucking companies without established credit.

How fast do truck factoring companies pay?

Most quality truck factoring services pay within 24 hours. Some truck factoring companies offer same-day funding, and the best provide weekend/holiday payments through their truck factoring service.

Do I have to factor all invoices with a truck factoring company?

It depends on the truck factoring company. Some require all invoices from factored customers, while other truck factoring services offer spot factoring where you choose individual invoices.

What's the difference between truck factoring and Quick Pay?

Quick Pay is offered directly by brokers (usually 2-5% fee). Truck factoring involves selling invoices to a third-party truck factoring company who handles collections as part of their truck factoring service.

Can I switch truck factoring companies?

Yes, but check your current truck factoring contract terms first. Some truck factoring companies have termination fees or notice requirements. Ensure all outstanding invoices are resolved before switching truck factoring services.

What documents do truck factoring companies need?

Truck factoring services typically require:

- Signed bill of lading/proof of delivery

- Rate confirmation

- Clear invoice

- Any supporting documentation the truck factoring company requests

Is truck factoring worth it for owner-operators?

For most owner-operators, yes. The improved cash flow from truck factoring services usually outweighs the fees, especially when starting out or growing your trucking business.

What happens if my customer doesn't pay the truck factoring company?

With recourse truck factoring, you buy back the invoice. With non-recourse truck factoring services, the truck factoring company absorbs the loss (check what situations are covered).

Can I use truck factoring if I'm leased to a carrier?

No, you must be operating under your own authority and invoicing customers directly to use truck factoring services.

What is the truck factoring definition in simple terms?

Truck factoring definition: It's when truck factoring companies buy your unpaid freight bills for immediate cash, minus a small fee, so you don't wait 30-90 days for payment.

Making Truck Factoring Work for Your Business

Success with truck factoring services comes down to choosing the right truck factoring company and using the service strategically. Here's my advice after years working with truck factoring companies:

- Start with non-recourse truck factoring if you're new - The extra protection from truck factoring companies is worth the slightly higher truck factoring rates while you learn which brokers to trust.

- Use technology from modern truck factoring companies - Choose truck factoring services with mobile apps and online portals. Submitting invoices to your truck factoring company from the road should be simple.

- Build relationships with your truck factoring company - Your truck factoring service should be a partner, not just a vendor. The best truck factoring companies help you grow.

- Keep good records for truck factoring - Clean paperwork means faster funding from truck factoring services. Organize your documents from day one.

- Plan your truck factoring strategically - Factor invoices through your truck factoring company strategically. You don't always need to use truck factoring for every load if cash flow is strong.

The Bottom Line on Truck Factoring in 2026

Truck factoring isn't just about getting paid faster - it's about building a sustainable, growing trucking business. The right truck factoring company provides not just cash flow but also back-office support, industry insights, and protection from bad debt through their truck factoring services.

Whether you're a single owner-operator just starting out or running a growing fleet, there's a truck factoring service that fits your needs. The best truck factoring companies offer fair truck factoring rates, excellent service, and the features you need to keep rolling.

Remember: The best truck factoring company isn't necessarily the cheapest - it's the one that helps your business thrive through quality truck factoring services. With the truck factoring companies available in 2026, you can find a partner that offers fair rates, excellent service, and the truck factoring features you need to succeed.

Ready to get started with truck factoring? Contact any of the best truck factoring companies above for a free quote and see how truck factoring services can transform your cash flow. Your business - and your stress levels - will thank you for choosing the right truck factoring company.